We build, buy, and invest in startups that would benefit from connections to Australia’s leading bank, and could improve the lives of its 15 million customers.

We're made to scale. To move and grow, learn and thrive.

Our ventures

We're helping CommBank reimagine what it means to be a bank, with products and services that improve people's lives in the moments that matter.

Built and owned

Home-in

2020

Home

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

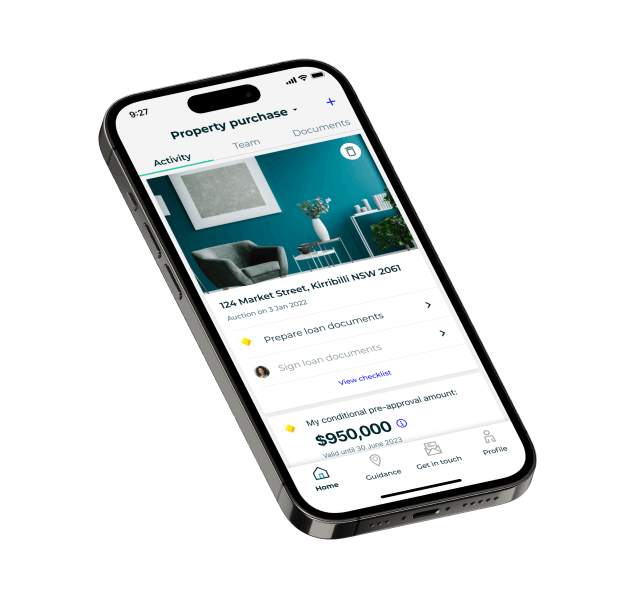

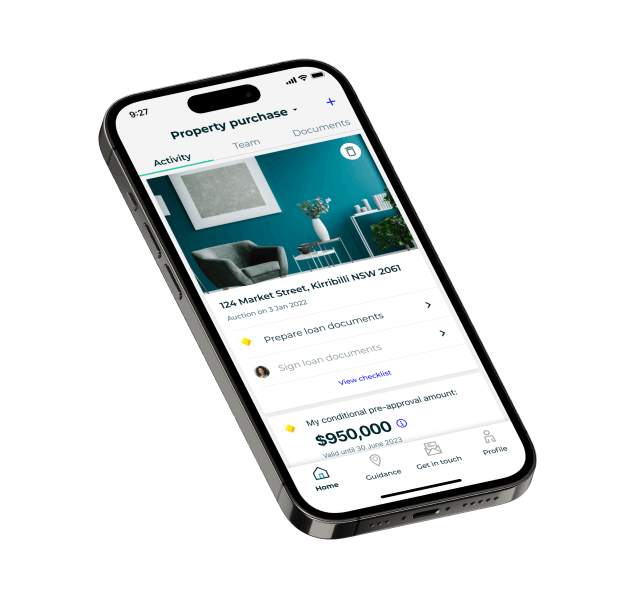

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Home-in

2020

Home

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Credit Savvy

2020

Everyday

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy powers a free credit score service in the CommBank app.

Credit Savvy powers a free credit score service in the CommBank app.

Credit Savvy

2020

Everyday

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy

Credit Savvy powers a free credit score service in the CommBank app.

Credit Savvy powers a free credit score service in the CommBank app.

Doshii

2021

Business

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

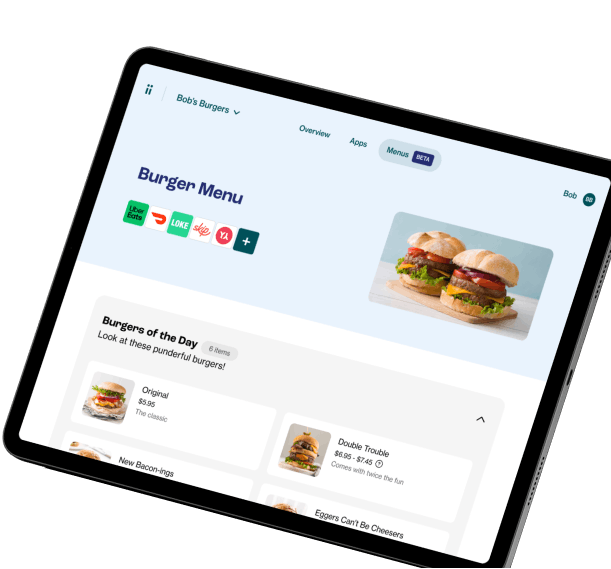

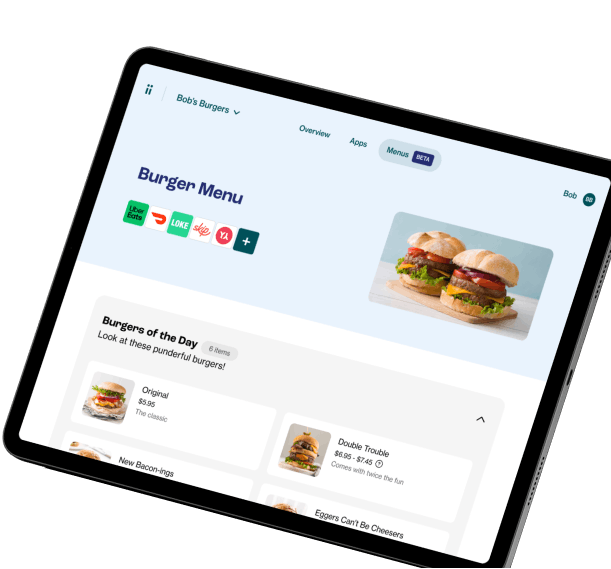

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Doshii

2021

Business

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Unloan

2022 (joined CBA, 2024)

Home

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

Unloan

2022 (joined CBA, 2024)

Home

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

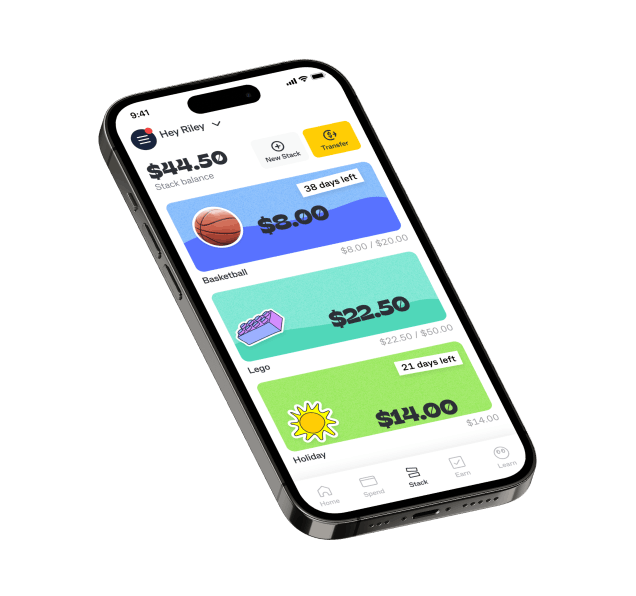

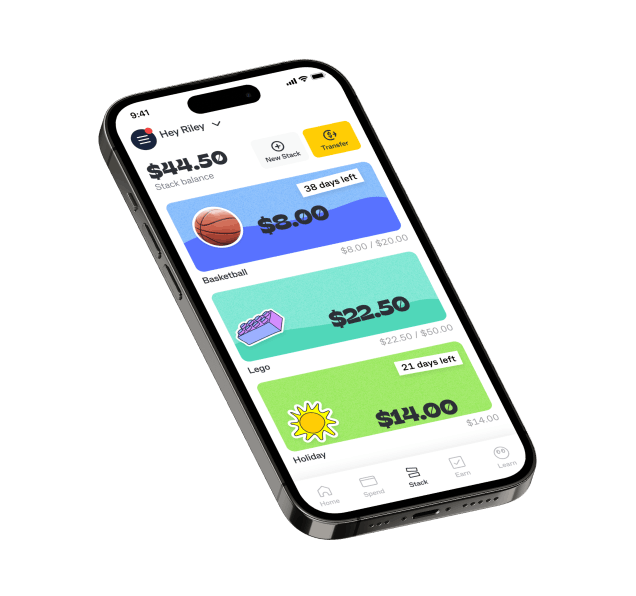

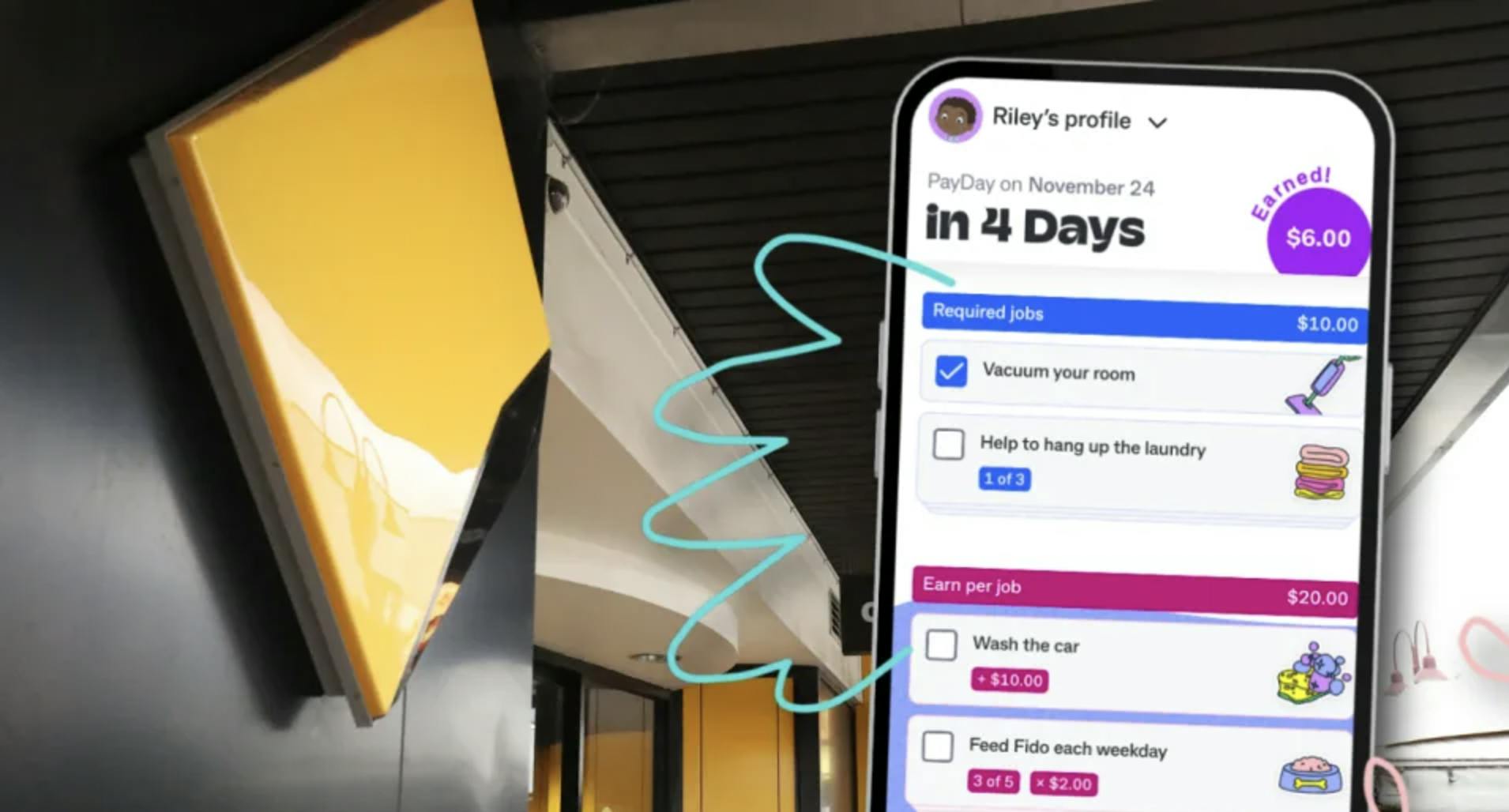

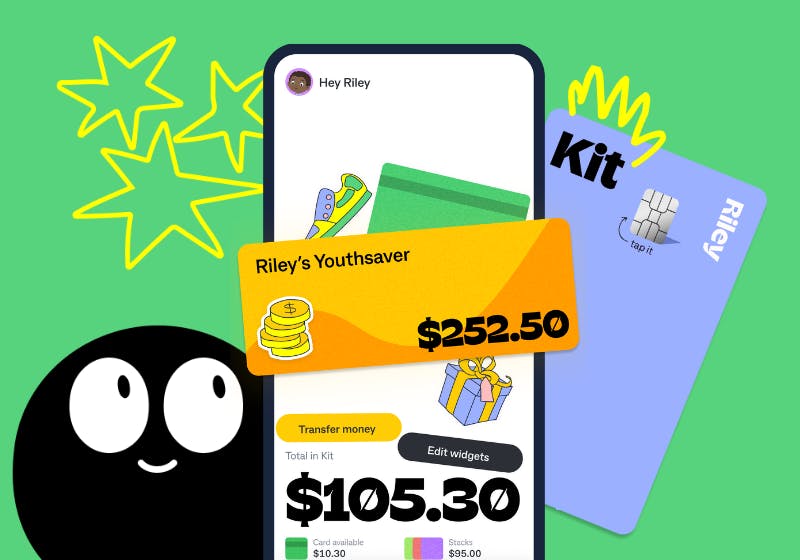

Kit

2022

Everyday

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

Kit

2022

Everyday

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

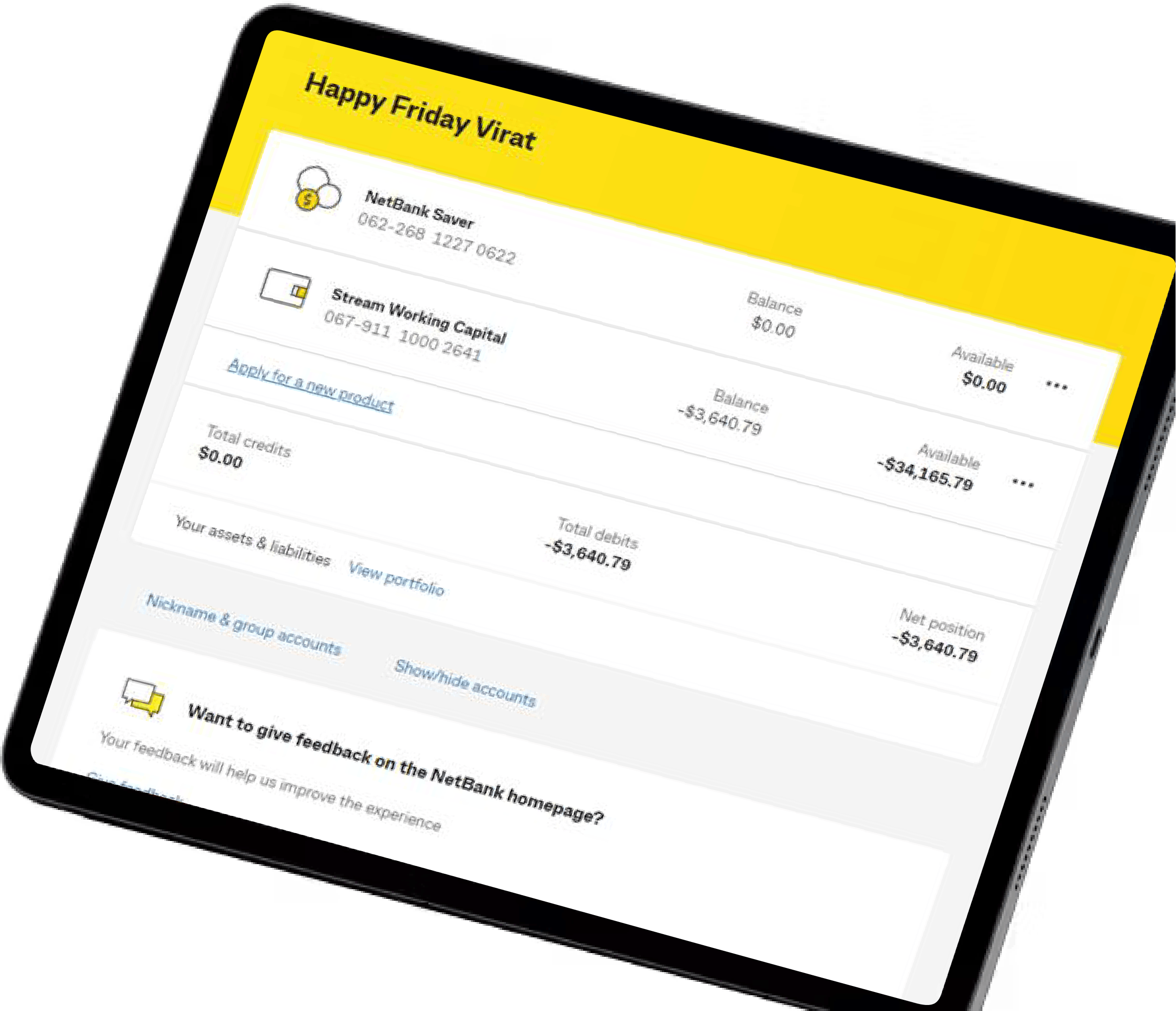

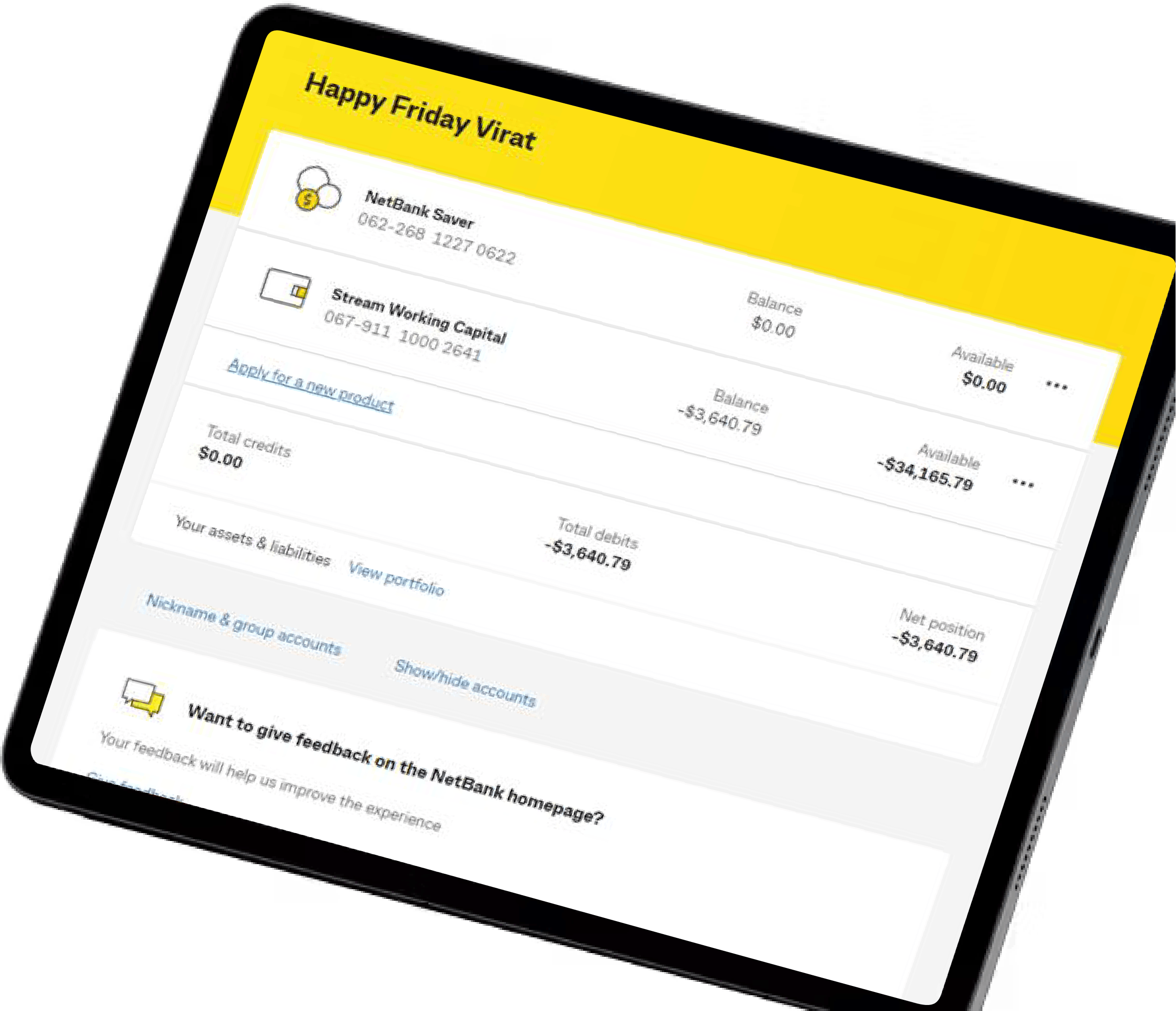

Waddle

2023

Business

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Waddle

2023

Business

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

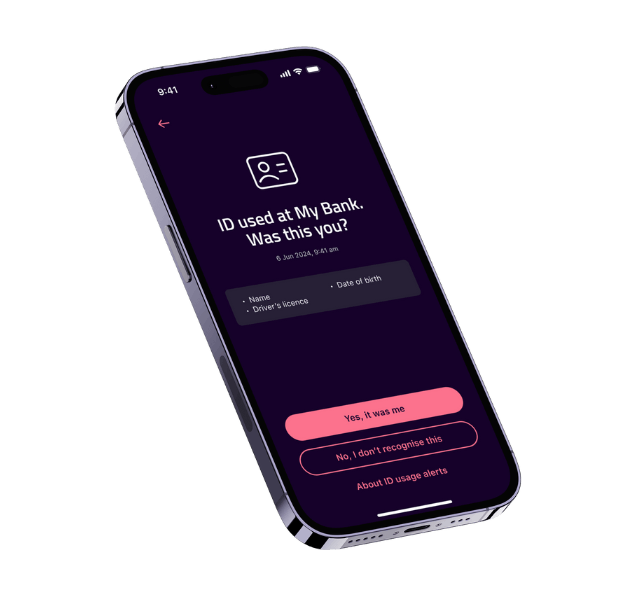

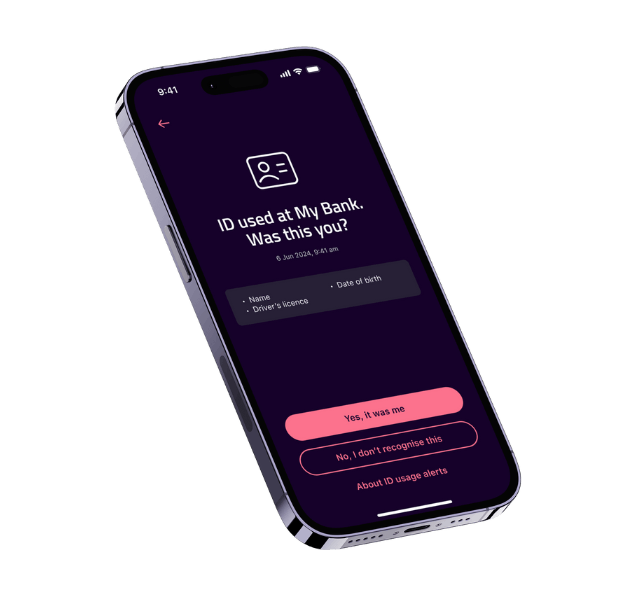

Truyu

2024 (In pilot)

Everyday

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu is a digital identity protection tool that alerts consumers the moment their identity is being used – or misused – online at major merchants across Australia, as well as when their credentials have been exposed in a data breach. Currently in pilot with early customers.

Truyu is a digital identity protection tool that alerts consumers the moment their identity is being used – or misused – online at major merchants across Australia, as well as when their credentials have been exposed in a data breach. Currently in pilot with early customers.

Truyu

2024 (In pilot)

Everyday

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu

Truyu is a digital identity protection tool that alerts consumers the moment their identity is being used – or misused – online at major merchants across Australia, as well as when their credentials have been exposed in a data breach. Currently in pilot with early customers.

Truyu is a digital identity protection tool that alerts consumers the moment their identity is being used – or misused – online at major merchants across Australia, as well as when their credentials have been exposed in a data breach. Currently in pilot with early customers.

Early-stage investments

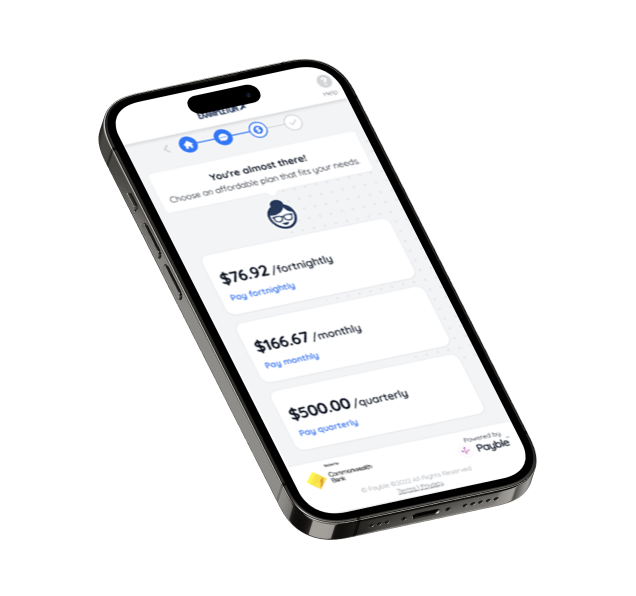

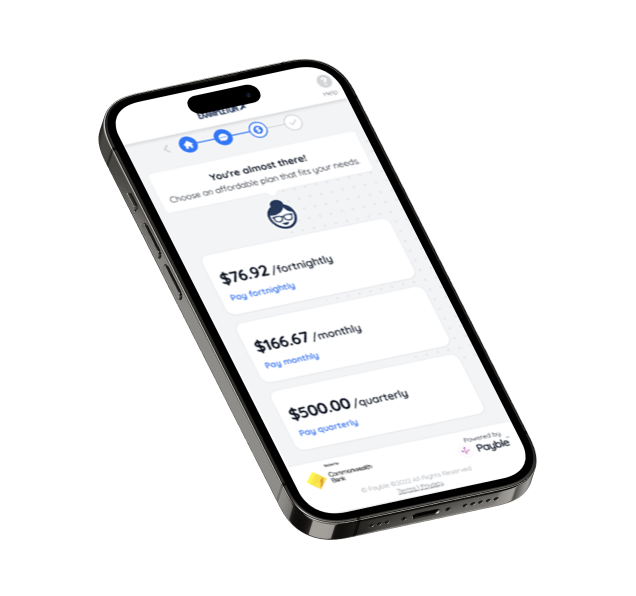

Payble

2021

Everyday

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble is a citizen-centric revenue optimisation platform, helping governments improve both revenue outcomes and citizen payment experiences.

Payble is a citizen-centric revenue optimisation platform, helping governments improve both revenue outcomes and citizen payment experiences.

Payble

2021

Everyday

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble is a citizen-centric revenue optimisation platform, helping governments improve both revenue outcomes and citizen payment experiences.

Payble is a citizen-centric revenue optimisation platform, helping governments improve both revenue outcomes and citizen payment experiences.

Xccelerate investments

OwnHome

2020

Home

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

OwnHome

2020

Home

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

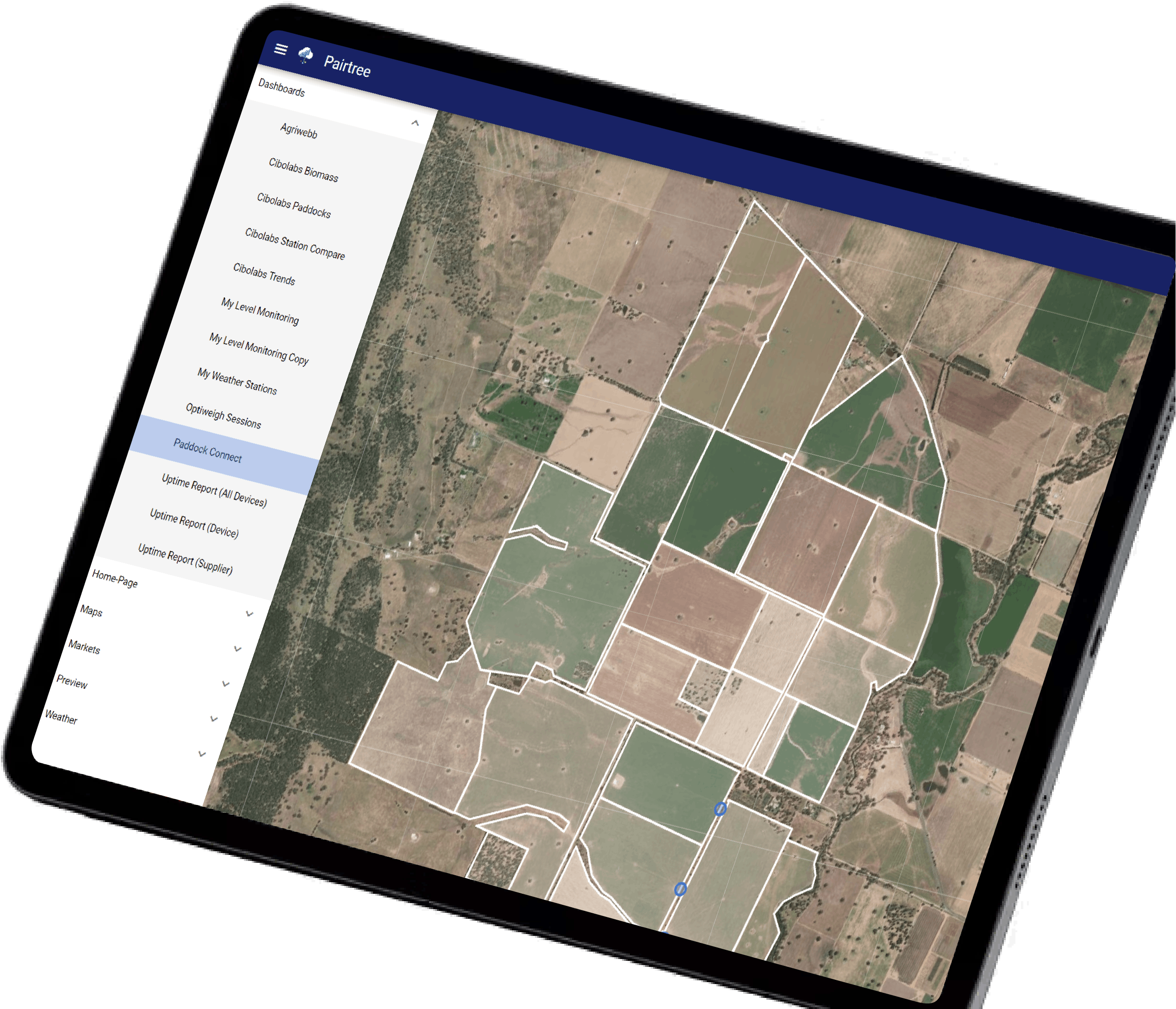

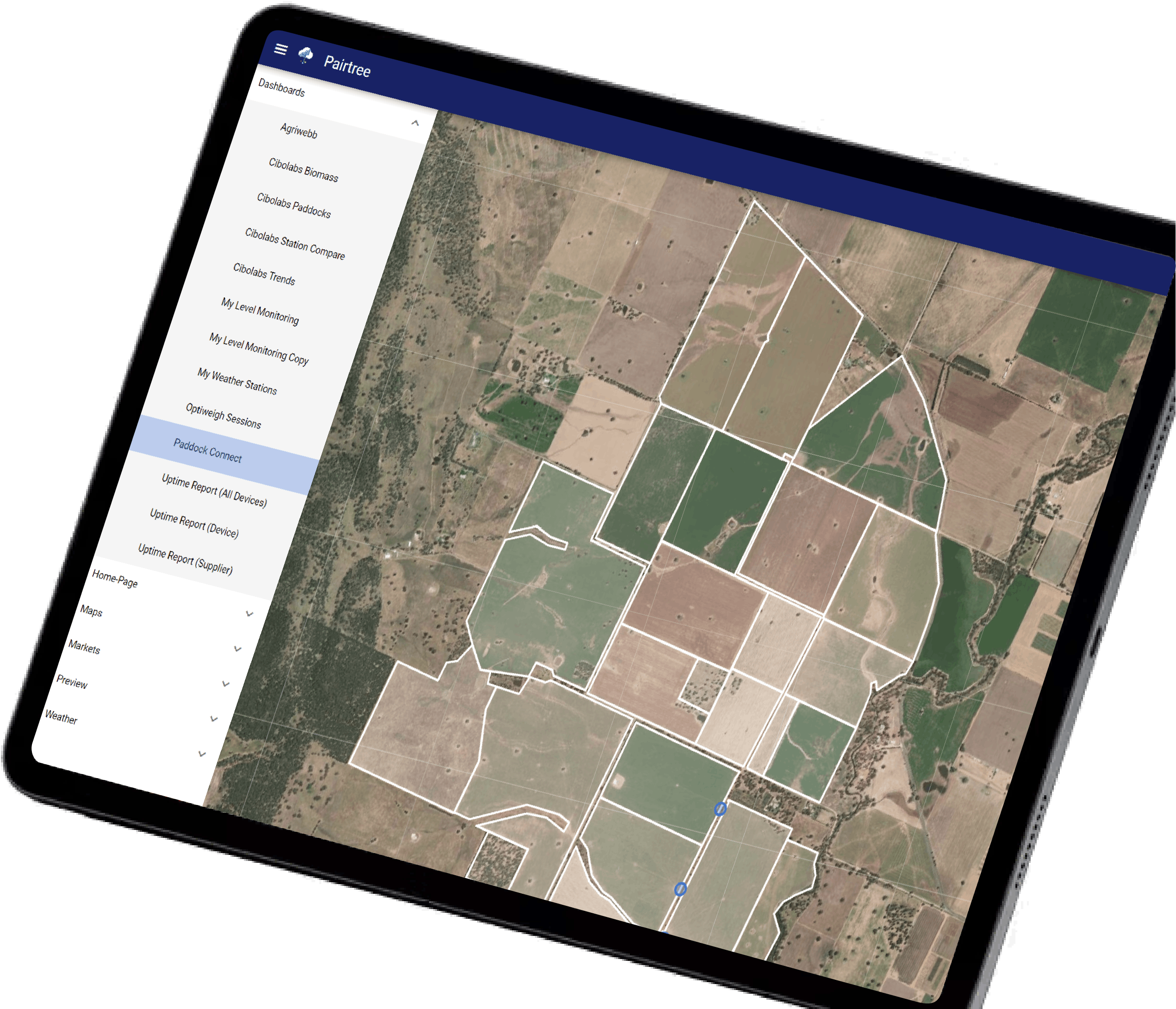

Pairtree

2023

Business

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Pairtree

2023

Business

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Gable

2024

Business

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable is a shift-left data change management platform enabling full data visibility and governance.

Gable is a shift-left data change management platform enabling full data visibility and governance.

Gable

2024

Business

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable

Gable is a shift-left data change management platform enabling full data visibility and governance.

Gable is a shift-left data change management platform enabling full data visibility and governance.

We exist in the space between corporate and startup.

It's a place full of opportunity, tension, and potential. Where strategic alignment is critical and operational autonomy is intentional.

We share CommBank's purpose - to build a brighter future for all – and build, buy and invest in digital ventures we believe could benefit its 15 million customers and beyond.

The Space

A place to explore our model and methods, go behind-the-scenes of our ventures, and get to know the humans within x15. These are our stories from The Space Between.

Between

www.capitalbrief.com

Media

x15 & Triple Bubble: Up Bank founder's next bubble

Bronwen Clune and Daniel Van Boom

29/9/2025

thewest.com.au

Media

Pocket money goes digital as Aussie parents start transferring money to kids’ bank cards

Kate Emery

29/9/2025

www.startupdaily.net

Media

Dom Pym’s fintech fund, Triple Bubble, pairs up with CommBank’s VC arm, x15ventures

Simon Thomsen

18/9/2025

www.9news.com.au

Media

CommBank tightens anti-scam technology with AI tool and new layer of in-app security

April Glover

11/8/2025

www.capitalbrief.com

Media

CBA's x15ventures invites other corporates to join its startup program

Andrew Cornell

4/3/2025

www.commbank.com.au

Media

x15ventures names Gable as Xccelerate winner

x15ventures

19/2/2025

au.finance.yahoo.com

Media

Commonwealth Bank offers Aussie kids interest on pocket money: 'Avoid $20,000 mistake'

Stewart Perrie

18/11/2024

x15venturesv2.cdn.prismic.io

Media

Kit launches Australian-first feature to help kids earn and learn about interest

Kit

17/11/2024

www.capitalbrief.com

Media

x15ventures celebrates first major 'exit' as Unloan graduates into CBA division

Daniel Van Boom

22/10/2024

www.techrepublic.com

Media

CBA’s x15ventures Set to Lead in Fintech AI Innovation

Matthew Sainsbury

14/8/2024

www.capitalbrief.com

Media

How CBA's x15ventures is redefining corporate venture capital

Andrew Cornell

29/7/2024

www.kidsnews.com.au

Media

Australian students need to be taught scam signs, online security

Diana Jenkins

28/7/2024

www.theaustralian.com.au

Media

CBA’s Xccelerate flags $250,000 for AI startups

Joseph Lam

11/7/2024

www.afr.com

Media

CBA beats government to start-up opportunity from data breach scandals

Paul Smith

6/5/2024

www.mi-3.com.au

Media

Fewer, bigger bets: CommBank’s x15ventures doubles down on scaling winners

Nadia Cameron

6/12/2023

9now.nine.com.au

Media

Next generation could be better at handling money, new data suggests

Tom Livingstone

1/5/2023

www.afr.com

Media

Why CBA hired more grads in tech than banking

Tess Bennett

23/3/2023

www.itnews.com.au

Media

CBA remains focused on digital

Kate Weber

15/2/2023

www.smartcompany.com.au

Media

Doshii, Uber and CommBank walk into a bar… to fix messy ordering systems

Tegan Jones

20/1/2023

www.smartcompany.com.au

Media

How Paytron automated payments to become one of Australia’s fastest growing startups

Pin Payments

12/12/2022

tieronepeople.com

Media

x15 and Paytron: challenges associated with working with major banks on innovation agendas

Dexter Cousins

25/10/2022

www.sub11.com.au

Media

Yish Koh speaks about her personal journey to Kit on Sub11

Chris Titley

11/10/2022

www.startupdaily.net

Media

Sydney fintech Paytron has won the Xccelerate 2022 run by the Commonwealth Bank’s x15ventures, l...

Simon Thomsen

30/9/2022

www.linkedin.com

Media

:Different named one of LinkedIn’s Top Startups 2022

LinkedIn News Australia

28/9/2022

www.startupdaily.net

Media

Here are the 4 startups CBA’s x15ventures is looking at backing

Simon Thomsen

27/9/2022

tieronepeople.com

Media

Kit’s Yish Koh on teaching Kids about money

Joanne Cousins

20/6/2022

www.itnews.com.au

Media

x15ventures switches focus from build to benefits

Kate Weber

9/6/2022

www.afr.com

Media

CBA backs ‘live now, buy later’ start-up that will ditch home deposits

Paul Smith

3/2/2022

www.itnews.com.au

Media

CBA's x15 launches deal finder app Cheddar

Kate Weber

16/11/2021

www.afr.com

Media

How CBA start-up plans to ward off threat from big tech

Paul Smith

26/10/2021

www.commbank.com.au

Media

A career in STEM can be for anyone

CBA

15/10/2021

www.mi-3.com.au

Media

'We’re just getting started', says CommBank's x15ventures' chief

Brendan Coyne

13/10/2021

www.commbank.com.au

Media

CBA’s x15 invests in property disruptor

CBA

22/9/2021

www.itnews.com.au

Media

CBA's x15ventures invests $150k in Splashup

Kate Weber

8/8/2021

www.commbank.com.au

Media

x15ventures reimagines its Xccelerate21 Community Day

CBA

6/8/2021

www.commbank.com.au

Highlight

Culture

x15ventures engineer appointed as latest Distinguished Engineer

CBA

4/8/2021

www.commbank.com.au

Media

Xccelerating the future of retail

CBA

1/7/2021

reading.afterwork.vc

Media

OwnHome close $3.6m pre-seed round

Annabel Action

23/6/2021

www.startupdaily.net

Media

x15ventures is looking for retail innovation startups for its next accelerator program

Simon Thomsen

21/6/2021

www.itnews.com.au

Media

x15ventures-owned Doshii hires up

Kate Weber

24/5/2021

www.xero.com

Media

Vonto: Easy business insights

Nick Houldsworth

30/4/2021

www.commbank.com.au

Media

Culture

Making the jump from corporate to startup

Louise Proctor

28/4/2021

www.afr.com

Media

CBA creates ‘xStack’ platform to sell to others

James Eyers

27/4/2021

www.itnews.com.au

Media

CBA's x15ventures invests $1 million in Payble

Kate Weber

12/4/2021

tieronepeople.com

Media

Culture

Taking a different approach to CVC – Toby on Fintech Chatter

Joanne Cousins

28/1/2021

www.itnews.com.au

Media

CBA's x15ventures appoints two fintech specialists

Luke Badawy

27/1/2021

www.commbank.com.au

Media

x15ventures marks one year with acquisition of Doshii

Luke Badawy

28/1/2021

© 2023 CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 and Australian Credit Licence 516487, trading as x15ventures. x15ventures is a trade mark of CBA New Digital Businesses Pty Ltd. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia. Please refer to the venture websites for specific venture-related disclosures and other important information. Read our Privacy Policy.

© 2023 CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 and Australian Credit Licence 516487, trading as x15ventures. x15ventures is a trade mark of CBA New Digital Businesses Pty Ltd. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia. Please refer to the venture websites for specific venture-related disclosures and other important information. Read our Privacy Policy.